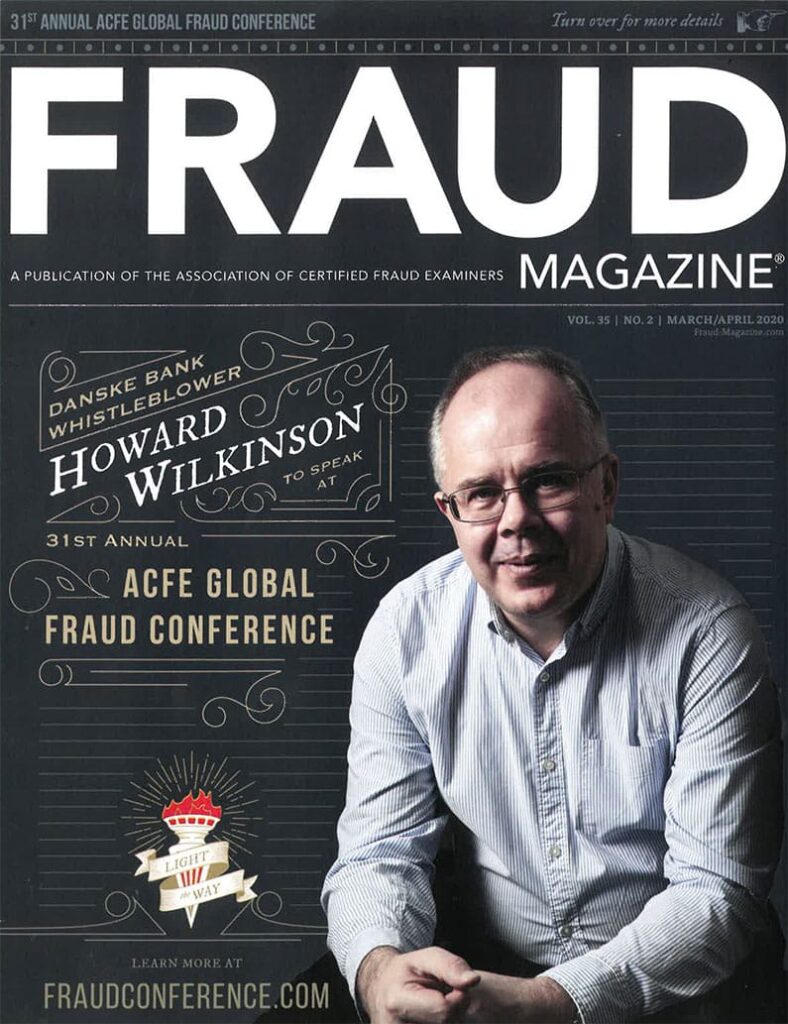

Howard Wilkinson exposed a $230 billion money laundering scheme — the largest in history.

Former Danske Bank manager Howard Wilkinson exposed a scheme that moved rubles out of Russia, converted them to dollars at the Estonian branch of Danske Bank, and then moved the dollars to New York with help from Bank of America, J.P. Morgan, and Deutsche Bank.

In September 2018, a massive $230 billion money laundering scandal erupted. The scheme involved the illicit movement of rubles out of Russia. These funds were then converted into US dollars at the Estonian branch of Danske Bank.

To facilitate this operation, the laundered money flowed through three major US correspondent banks: Bank of America, J.P. Morgan, and Deutsche Bank.

Danske Bank acknowledged a complete failure of its internal controls designed to prevent money laundering. A whistleblower had internally reported this illicit activity to senior bank management four years prior to the scandal’s public exposure.

Despite the bank’s efforts to maintain the whistleblower’s anonymity, their identity was quickly leaked. The international banking community soon learned that Howard Wilkinson, a former Danske Bank manager, had bravely exposed the largest money laundering operation in history and that the bank had attempted to conceal it.

Wilkinson confidentially reported his findings to senior management within Danske Bank, including its Copenhagen headquarters.

His disclosures prompted a high-level internal audit, which quickly corroborated his concerns. However, the audit findings were never officially released, and the bank initiated efforts to conceal its involvement in the illicit activities.

By April 2014, only four months after his initial reports, Wilkinson resigned from Danske Bank on ethical grounds. He could no longer work for an institution potentially engaged in large-scale criminal activity.

Despite his exemplary service record, Danske Bank readily terminated his employment and compelled him to sign a restrictive non-disclosure agreement as a condition for receiving his severance pay.

This account is based on Wilkinson’s responses to a questionnaire submitted by the European Parliament’s Special Committee on Financial Crimes, Tax Evasion and Tax Avoidance (TAX3).

News of the scandal emerged gradually.

Danske Bank commissioned an external law firm to investigate its actions. The law firm’s report, published in September 2018, shocked the banking world.

The report confirmed the critical role of a whistleblower, stating:

“It was a whistleblower… that made [the Bank] realize that AML procedures… had been manifestly insufficient and inadequate and that all three lines of defense… had failed.”

The report detailed the whistleblower’s initial disclosures to senior bank management:

“A customer… filed false financial accounts.”

“The bank knowingly continued to deal with a company that had committed a crime.”

“The bank continued dealing with [a] company even after it had committed another crime by submitting amended false accounts.”

The whistleblower also reported to management that one of the suspicious accounts “apparently… included the Putin family and the FSB,” the Russian Federal Security Service.

The law firm’s report acknowledged significant deficiencies in the bank’s internal controls and governance, enabling the Estonian branch to be exploited for criminal activities like money laundering. Crucially, “there was no reporting to authorities,” and “the allegations brought forward by the whistleblower were not properly investigated.”

The report vindicated the whistleblower while protecting their anonymity in accordance with European privacy laws. However, their identity was illegally leaked shortly after the report’s release.

Following the leak, Mr. Wilkinson’s identity became public. He and his legal counsel subsequently testified before both the Danish and European Parliaments. His story was also covered by prominent media outlets, including The Wall Street Journal and 60 Minutes.

While the scope of ongoing investigations into the Danske Bank money laundering scheme remains largely undisclosed, significant actions have been taken in Europe.

- Criminal charges have been filed against several individuals.

- High-level bank executives have resigned.

- The Estonian branch of Danske Bank has been closed.

Furthermore, other major international banks implicated in the scandal have faced police raids and are subject to extensive civil and criminal investigations.

According to Reuters, Deutsche Bank has been added to the list of potential targets in an expanding U.S. Department of Justice investigation into the Danske scandal.

“The U.S. Department of Justice has in recent weeks stepped up its investigation into Deutsche Bank’s role in the 200 billion euro ($220 billion) Danske Bank money laundering scandal…Officials from the DoJ, who have been working closely with Estonian prosecutors for around a year, have also begun cooperating with Frankfurt state prosecutors.”

Howards whistleblowing has recovered over $2 billion for victims of the fraud:

THE SMOKE DETECTOR

An interview with Danske Bank whistleblower Howard Wilkinson

In 2020, the Association of Certified Fraud Examiners, one of the world’s largest and most respected organizations of auditors, compliance officials, and fraud examiners, gave Mr. Wilkinson it highest honor: The Cliff Robertson Sentinel Award “For Choosing Truth Over Self.”